This resource offers insights and examples into how Economic Development Districts (EDDs) can incorporate wealth creation into both their Comprehensive Economic Development Strategy (CEDS) process and content. There are also examples of how individual EDDs have accomplished this, along with links to tools that can help you get started.

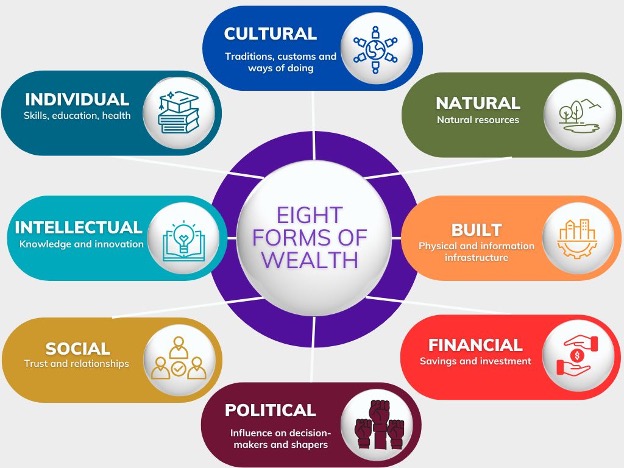

Wealth creation is a community-centered, systems approach to community and economic development that applies a distinctive lens to asset-based development. Wealth creation uses a value chain approach to connect the community’s existing assets with new market opportunities to build wealth and create livelihoods that are rooted locally. The focus is on supporting local ownership and building on existing assets to strengthen and grow the local economy.

Wealth creation allows communities to focus on what they have— instead of what they lack—to generate new and sustainable economic opportunities that are rooted in local people, places and businesses.

This framework supports and builds upon existing economic development programs like the CEDS, while allowing a more refined and local approach to economic development planning that ensures that the capacity and resources generated by the plan stay in the community.

The strength of the wealth creation approach is in its inherent flexibility.

1. Recognize and build multiple forms of wealth.

2. Promote local ownership and control of assets.

3. Improve livelihoods for those currently living on the economic and social margins.

According to the US Economic Development Administration (EDA), “The Comprehensive Economic Development Strategy (CEDS) contributes to effective economic development in America’s communities and regions through a place-based, regionally driven economic development planning process.” In recent years, Economic Development Districts (EDDs) have included wealth creation strategies in their CEDS to ensure long-term, generational benefits for communities, moving beyond traditional economic growth towards more sustainable and wide-ranging prosperity. EDDs have incorporated wealth creation into the CEDS by:

Fostering Asset-Based Economic Development by Leveraging Local Assets and Community-Owned Wealth. EDDs identify unique local resources, such as natural landscapes, cultural heritage, or industrial capabilities, on which to build opportunities. EDDs promote structures of local ownership and control of assets through cooperatives, employee-owned businesses, or land trusts that keep wealth within the community.

Encouraging Local and Regional Entrepreneurship Through Support for Small Businesses, Social Enterprises, and Anchor Institutions. EDDs can offer initiatives such as microloans, technical assistance, and incubators for local entrepreneurs. Some EDDs promote business opportunities that combine profit-making with addressing community challenges. EDDs often leverage hospitals, universities, and large regional employers to support local procurement and entrepreneurship.

Enhancing Capital Access through Innovative Financing Tools and Public Infrastructure Projects. EDDs facilitate revolving loan funds, public-private partnerships, and opportunities to attract investment while maintaining community control. Through support for investments in transportation, broadband, and utilities, EDDs can lower costs and enable economic participation.

Measuring Wealth Creation Beyond Jobs: EDDs can evaluate success through metrics such as income growth, different kinds of wealth retained locally, and economic mobility.

Wealth creation is an important lens through which to view the CEDS content as well as the CEDS process. The CEDS planning process offers a useful opportunity to engage a diverse group of stakeholders in taking stock of what’s happening on the ground locally and imagining what could be. EDA recommends a variety of steps:

1. Establish and maintain a CEDS Strategy Committee.

2. Define the Strategy Committee’s roles and relationships.

3. Leverage staff resources.

4. Adopt a program of work.

5. Seek stakeholder input on an initial CEDS document.

6. Finalize CEDS document including stakeholder input.

7. Submit a CEDS Annual Performance Report.

8. Revise/update the CEDS (at least every five years).

There are many ways to incorporate wealth creation principles and strategies into the CEDS planning process. For example, engaging the CEDS Strategy Committee and other stakeholders can be an important first step:

EDDs engage stakeholders in different ways. For example, the Acadiana Planning Commission in Louisiana held three CEDS Strategy Meetings, including one on the successes of the region’s economic development activities; one for the SWOT Analysis, which incorporated the eight capitals; and one for Future Goals, Objectives, and Strategies of the Region.

Region Five Development Commission (R5DC), an EDD based in Staples, Minnesota, engages CEDS stakeholders based on their strengths in building specific capitals. See the CEDS Strategy Committee to the right, noting the “Economic Interest by WealthWorks capital” column. R5DC calls its version a Comprehensive Regional Economic Development Strategy or CREDS.

Find the Opportunities to Build Partnerships worksheet on the NADO Wealth Creation microsite and below. This worksheet provides an opportunity to consider current and future CEDS Committee members based on their strengths in building different regional and community capitals, as well as the value propositions, messages, and methods to use in engaging them.

Another resource to explore is NADO RF’s How to Build the CEDS Strategy Committee brief.

Each of the required sections of the CEDS provides an opportunity to incorporate wealth creation concepts and approaches. The sections are briefly summarized below:

This is a summary background of the economic conditions of the region. The question to be answered here is “What have we done?” and “What is going on in our region?”

The opportunity here is to report the conditions of the region across the eight capitals. This might include the obvious ones: jobs and employment, educational attainment, revenues, income. But it may also include conditions of natural capital, cultural capital, intellectual capital, and more.

This is an in-depth analysis of regional strengths, weaknesses, opportunities, and threats (also known as a SWOT Analysis). Other, similar types of analysis are suggested by EDA, like SOAR (Strengths, Opportunities, Assets, and Risks) or NOISE (Needs, Opportunities, Improvement, Strengths, and Exceptions). For those who do not want to focus on negatives or who want to be more effective in engaging the broadest group of stakeholders, these may be more forward-looking and engaging methodologies to use.

The SWOT or alternative analyses are a useful opportunity to engage stakeholders, whether through a survey, interviews, focus groups, or in-person meetings and better understand the region’s needs.

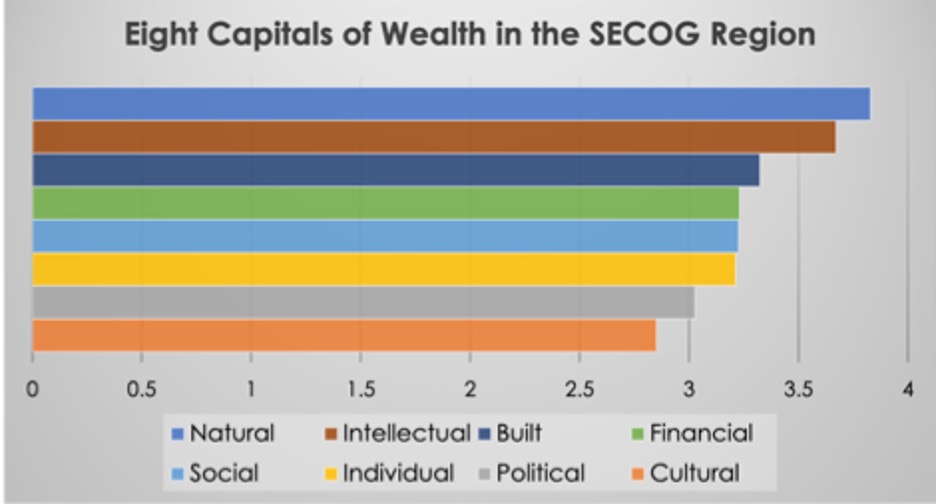

The South Eastern Council of Governments (SECOG) in South Dakota used a survey to undertake its SWOT using the WealthWorks eight capitals. In addition, survey participants were asked to rank each of the eight capitals of wealth using a Spider Diagram.

Find a SWOT Analysis Template on the NADO Wealth Creation microsite.

The Strategic Direction/Action Plan section builds on findings from the SWOT analysis and incorporates/integrates elements from other relevant regional plans (e.g., land use and transportation, workforce development, emergency management, etc.). It also identifies the stakeholders responsible for implementation, timetables, and opportunities for the integrated use of local, state, and federal funds.

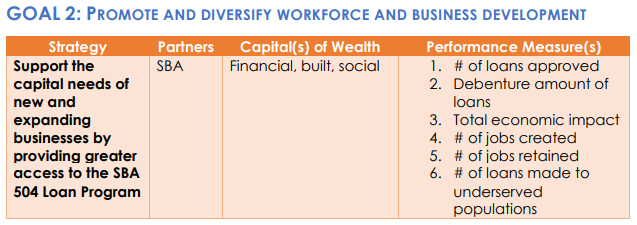

In the SECOG CEDS, there are three key goals in the action plan:

Each goal has multiple strategies, each of which notes key partners, capitals affected, and measures.

According to R5DC’s CEDS, “By considering the eight asset banks outlined in this model, goals and strategies cross typical boundaries by asking the question, ‘who else cares about this?’, in turn encouraging collaboration and efficiency in using available resources.” In the Industry and Innovation area and the Social Capital area of the CEDS, R5DC notes a few key strategies:

Industry and Innovation:

Social Capital:

Clearwater Economic Development Association (CEDA) in Idaho identifies in its Entrepreneurship, Business Development and Economic Empowerment Objective a task to “Execute WealthWorks Value Chain mapping to identify and address supply chain gaps and bottlenecks for regional businesses, artisans, and small producers.”

Buckeye Hills Regional Council identifies under the goal of “Work collaboratively with communities to enhance development opportunities surrounding” an objective of “Buckeye Hills staff will complete one (1) regional WealthWorks training for local community officials and one (1) intro to WealthWorks webinar per year for local stakeholders.”

Upper Coastal Plain Council of Governments (UCPCOG) identifies in its Action Plan a key vision that “Community wealth is generated throughout the Upper Coastal Plan Region,” with initiatives including to “improve the region’s ability to foster a diverse, thriving economy;” “Define and promote the region’s sense of place;” and “Build on the region’s competitive advantages and leverage the marketplace.”

Even if wealth creation is not explicitly mentioned in the CEDS, there are elements of it (building wealth, keeping wealth local, building livelihoods) in many CEDS. In the Southern Colorado Economic Development District CEDS, one strategy mentions “Develop and share in the ownership of publicly owned broadband assets.”

The Central South Dakota Enhancement District CEDS references local ownership and control of assets when it lays out the strategy to “Encourage local leaders to invite youth to become involved in organizations, committees, and governing bodies in order to encourage “ownership” of a community.”

The Southern Tier 8 Regional Board in New York references in its CEDS the strategy to “Continue to build a regional local-ownership entrepreneurial community,” also referencing local ownership and control of assets.

The Blackhawk Hills Regional Council in Illinois in its CEDS suggests the opportunity to “Discuss employee stock ownership plan (ESOP) and related models with proprietors.”

The Evaluation Framework is used in the CEDS to evaluate the organization’s implementation of the CEDS and the resulting impact on the regional economy.

Snowy Mountain Development Corporation, an EDD based in Lewistown, Montana, establishes in its Evaluation section: “The organization and communities increase in the eight forms of wealth including: individual, social, intellectual, natural, built, political, financial, and cultural capital.”

For R5DC, “the WealthWorks model plays an important role when evaluating the effectiveness of the [CEDS] goals and strategies, ensuring that eight asset banks, intellectual, individual, social, cultural, natural, build, political and financial, are all considered.”

EDDs that incorporate wealth creation into their CEDS often include initiatives aimed at fostering local entrepreneurship, job creation, and long-term financial sustainability. While not all EDDs explicitly label their strategies as “wealth creation,” many include elements of it through programs that empower communities and enhance their economic resilience. Here are some notable examples:

There are some common themes across Economic Development Districts taking a wealth creation approach. These include:

Encouraging and prioritizing community ownership of resources by local individuals, organizations, and businesses resources.

Building regional markets that enhance local production, connecting it to broader markets, and creating jobs.

Promoting conservation of resources. Focusing on long-term, renewable economic benefits.

Providing loans and grants to support local or regional entrepreneurs and small businesses.

Engaging people and organizations that represent the entire socio-economic spectrum.

Providing education, training, and resources to empower residents. Training residents to fill high-quality jobs in growing industries.

Ethan Simon began as a Research Fellow at NADO in January 2025 after earning his bachelor’s degree in Public Policy from the University of Maryland, College Park, with minors in Law and Society and Geographic Information Science. During and after his undergraduate studies, Ethan built experience across state government, transportation advocacy, and nonprofit policy work, including positions with the Maryland General Assembly, the Government Affairs Department of the Southeastern Pennsylvania Transportation Authority (SEPTA), and as a Government Relations and Advocacy Intern for the National Council of Jewish Women. Ethan currently serves as Chair of Government Affairs for the SEPTA Youth Advisory Council, where he leads advocacy efforts to expand public transportation funding and strengthen transit planning throughout the Philadelphia region.

At NADO, he supports rural energy planning initiatives by contributing research to the Rural Energy Academy and assisting with broader programs focused on rural energy development and policy impacts on rural communities.

Now residing in Washington, D.C., Ethan enjoys playing basketball and football in his free time, as well as traveling. He is interested in U.S. history, sports, and geography, is a die-hard Buffalo Bills fan, and hopes to one day compete on Jeopardy.

Juliette Wilder is the Manager of Government Relations for the National Association of Development Organizations (NADO), where she supports congressional and executive branch outreach, coalition building, and advocacy efforts on behalf of more than 500 regional development organizations (RDOs) nationwide.

Prior to joining NADO, she was a Senior Policy Associate at Boundary Stone Partners, where she specialized in clean energy policy analysis, federal funding navigation, and legislative advocacy. In this role, Juliette coordinated with the Department of Energy on multi-million-dollar clean energy projects, spearheaded congressional and executive branch initiatives, and built partnerships to advance innovation in the energy transition.

She holds a Master’s degree in Global Environmental Policy from American University and a Bachelor’s in International Studies. Her academic research focused on energy equity and the Justice40 Initiative.

When not working, Juliette can be found community gardening, bouldering, or hiking.

Michael Matthews is the Director of Government Relations for the National Association of Development Organizations (NADO), where he leads congressional and executive branch outreach, coalition building, and advocacy efforts on behalf of more than 500 regional development organizations (RDOs) nationwide.

With over a decade of experience, Michael combines policy expertise with political acumen to advance federal policies that promote equitable community development, economic competitiveness, rural growth, economic mobility, and quality of place. Before joining NADO, he served as the Legislative Director for Community, Economic & Workforce Development at the National Association of Counties (NACo), collaborating with county officials to shape policies affecting local governments in areas such as housing, community and economic development, public works, and workforce initiatives.

Earlier in his career, Michael held various policy positions at the Association for Career and Technical Education (ACTE), Office of Congressman Anthony G. Brown (D-Md.), and contributed to several political campaigns across the Washington, D.C. metro area.

Michael holds a bachelor’s degree in political science from Salisbury University and a master’s degree in public administration from Wilmington University. A native of Delaware, he now resides in Lake Ridge, Virginia, with his wife and daughter.

Andrew Coker joined the NADO team in March of 2023 as a Regional Development Researcher after spending two and a half years as the Regional Economic Resiliency Coordinator at NADO-member organization West Central Arkansas Planning and Development District.

Now serving at NADO as a Program Manager, Andrew conducts research on the newest economic and community development best practices from Economic Development Districts across the country. He helps produce easily digestible information on complex regional issues through case studies, tip sheets, and research reports. Andrew also hosts training and professional development opportunities including conference sessions and virtual webinars for member regional development organizations.

Andrew holds a bachelor’s degree from Hendrix College and a master’s degree from the University of Arkansas Clinton School of Public Service. He is one of NADO’s three Missouri-based team members and enjoys reading and training for his next triathlon.

As Director of Programs, Jack Morgan manages the portfolio of NADO’s training, research, capacity-building, and other grant-funded programs and activities of the NADO Research Foundation. Jack previously served as a NADO Senior Program Manager and Associate Director, leading work supporting energy communities and the training programs for Emerging Leaders.

Jack joined the NADO team in 2022 after seven years with the National Association of Counties (NACo) as a Program and Senior Program Manager. Prior to NACo, Jack was a Policy Analyst for Friends of Southwest Virginia and interned for Mount Rogers Planning District Commission (VA). Jack holds a bachelor’s in geography from Emory & Henry College and a master’s in geography from Appalachian State University.

Jack is certified by the American Institute of Certified Planners (AICP) and is a member of the American Planning Association (APA) Regional & Intergovernmental Planning Division. He also serves on the Emory & Henry College Alumni Board.

Taking road trips, reading non-fiction, and indulging in top-notch barbecue and coffee round out Jack’s days. He loves maps, mountains, and of course, all things sports.

Kar’ron Grant joined the NADO team in 2023 as Administrative Specialist and is the first face (or voice) you’ll see or hear when reaching out to NADO. As Administrative Specialist, Kar’ron manages our database and coordinates NADO event operations. He ensures members’ needs are met, contact information stays current, and NADO’s office is running efficiently.

Kar’ron came to NADO after four years in the classroom teaching at The New Century School and Old Mill Middle North where he received the Patriot of the Year award. He attended Towson University and the University of Maryland Global Campus and holds a bachelor’s in international studies and humanities.

Visiting art galleries and museums, playing basketball and bowling, and taking in movies and music are some of Kar’ron’s interests and hobbies.

Deputy Executive Director Laurie Thompson has been with NADO for 25 years. Laurie helps keep the NADO and NADO Research Foundation wheels turning through management of the daily operations of the Research Foundation, securing financial resources and overseeing grants management, and helping execute NADO’s Annual Training Conference each year.

Laurie holds a bachelor’s in public affairs and government from Mount Vernon College and a master’s in health services administration from The George Washington University. Prior to NADO, Laurie spent time as a Field Specialist and an Eagle Staff Fund Director at First Nations Development Institute.

When she’s taking a rare reprieve from her NADO work, Laurie enjoys traveling domestically and internationally to visit friends and family.

Jamie McCormick joined the NADO team as a Policy Fellow in 2019 and now serves as a Senior Manager of Member Services. In this role, she supports NADO’s engagement with its membership, helping ensure members stay connected, informed, and supported. She assists with programs, communications, and events that strengthen relationships across the organization’s network.

Brett Schwartz began at NADO in 2012 as a Research Fellow after earning his J.D. from the University of Baltimore School of Law. The following year, he was promoted to Program Manager and has now been leading as an Associate Director since 2018. Brett is responsible for managing NADO’s Economic Development District Community of Practice (EDD CoP), as well as researching and monitoring the latest trends in regional economic development and resilience, including best practices for the Comprehensive Economic Development Strategy (CEDS). With more than a decade of experience on the NADO team, Brett is a dynamic relationship builder helping connect and build capacity among the national network of regional development organizations.

Brett also holds a bachelor’s degree from Georgetown University and a master’s from Trinity College Dublin, as well as a certificate in mediation training. He’s a member of Catalyst Grantmakers of San Diego and Imperial Counties and was a participant in the 2021-22 Field Trips to the Future Cohort.

Brett is one of NADO’s West Coast team members residing in San Diego, CA where he enjoys spending time outdoors, attending concerts and festivals, and soaking up life as a parent of two young children.

Katie Allison joined the team in 2023 to lead the strategic communication efforts of NADO. Katie creates and develops print and online materials, communicates NADO’s updates to members via weekly emails, and maintains content for nado.org and NADO’s social media channels. She also works with different departments to generate new ideas and strategies to effectively describe and promote the important work NADO is doing for EDDs and RDOs across the country.

An experienced nonprofit communications professional, Katie worked for organizations in western North Carolina for nearly a decade. She holds a bachelor’s in communications from Wingate University where she was a four-year student athlete.

Senior Program Manager Ciara Ristig has been a member of the NADO team since 2021, and helps with NADO’s EDD Community of Practice, EDD staff capacity building and other grants on a range of subjects, including equity and solar energy. Before NADO, Ciara worked as a Planner for the County of Santa Barbara and an Assistant Project Manager for REM Consult. Ciara holds a bachelor’s in urban studies and French from Bryn Mawr and a master’s in urban studies from Ecole d’Urbanisme de Paris.

When she’s not traveling, you can find her outrigger paddling and serving on the board of the Blue Sky Center in New Cuyama, CA, near her home base of Santa Barbara.

Carrie Kissel has been a member of the NADO team since 2005 and currently serves as Associate Director, Transportation. Carrie holds a bachelor’s in anthropology from Ball State University and a master’s in public anthropology from American University. In her role at NADO, Carrie provides technical assistance and support to rural regions on transportation and economic development issues. She also develops training and peer exchange events on transportation issues and rural wealth creation as an economic development strategy.

Carrie is a member of the Transportation Research Board (TRB) and serves as chair of the TRB Standing Committee on Transportation in Rural Areas.

Reading, gardening, hiking, and kayaking are a few of Carrie’s hobbies.

Melissa Levy has worked at NADO as a Wealth Creation Specialist since February 2023 and is the Principal Consultant at her own firm specializing in wealth-based economic development consulting. With a career spanning nearly 30 years, Melissa brings a breadth of knowledge to her role providing in-depth research, coaching, and training on regional economic resilience, rural wealth creation strategies, and economic development.

Melissa is a North American Food Systems Network trained AgriCluster Resilience and Expansion (ACRE) facilitator and a WealthWorks coach, facilitator, and trainer.

In addition to her professional work, Melissa serves on the Vermont Urban and Community Forestry Council, on the board of the Hinesburg Community Resource Center, and on the Hinesburg Economic Development Committee.

A true outdoorswoman, Melissa enjoys cross country and downhill skiing, paddleboarding, hiking, biking, and kayaking, as well as yoga, and teaching Tai Chi.

Senior Program Manager Krishna Kunapareddy began her role with NADO in February of 2023 after 14 years of service at Boonslick Regional Planning Commission in Missouri. Krishna manages NADO Research Foundation’s Planning and Environmental Linkages and Center for Environmental Excellence projects. In addition to researching and writing, Krishna also conducts virtual workshops on innovative tools and techniques related to transportation planning.

She holds an undergraduate degree from Andhra University and a master’s from JNT University in India, as well as a master’s in city and regional planning from the University of Texas at Arlington. Krishna is also a certified Smart Cities Academy Practitioner and holds the Location Advantage certificate from geographic information system software company ESRI.

In her spare time, Krishna volunteers with Mentors4College helping high schoolers better plan for their post-high school paths.

Bret Allphin joined NADO in April of 2022 bringing with him a wealth of knowledge after a 20-year career with Buckeye Hills Regional Council in Marietta, Ohio. In addition to his bachelor’s in political science and master’s in public affairs, Bret is a licensed Geographical Information Systems Professional (GISP). He is NADO’s go-to team member for all things mapping while also supporting members with transportation and economic development technical assistance services.

An avid sports aficionado and former collegiate athlete, Bret enjoys cheering on his Cincinnati Reds, hitting the trails on his mountain bike, and improving his golf game whenever possible. Bret is an involved community member in Marietta dedicating much of his spare time to serving on local nonprofit boards.

Applications cannot be saved and returned to at a later time. It is recommended you compile all of your information in advance in a word processor and cut and paste into the application below.

Joe McKinney serves as Executive Director of the National Association of Development Organizations (NADO). Headquartered in Washington DC, NADO provides advocacy, education, research, and training for the nation’s 500+ regional planning and development organizations.

Joe has more than 30 years of experience having served in city, county, regional, national association, and government management since 1991. He holds a bachelor’s degree in Public Policy Analysis from the University of North Carolina at Chapel Hill and is a candidate for a master’s degree in Public Administration from UNC-Chapel Hill.

McKinney has provided congressional testimony on numerous occasions regarding the importance of regional development organizations in helping shape the nation’s economic growth. He is nationally recognized for promoting innovative solutions in areas such as planning and economic development, workforce development, transportation and transit, and aging services.